01 Oct Why Dividends Matter to Investors

The amount you’ll receive is expressed as a value per share, such as 30 cents per share. The amount per share varies significantly depending on the company and its profitability. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form.

TAX CENTER

In practice, however, the coverage ratio becomes a pressing indicator when coverage slips below about 1.5, at which point prospects start to look risky. If the ratio is under 1, the company is using its retained earnings from last year to pay this year’s dividend. A dividend-paying stock generally pays 2% to 5% annually, whether in cash or shares. When you look at a stock listing online, check the “dividend yield” line to determine what the company has been paying out. Suppose Company X declares a 10% stock dividend on its 500,000 shares of common stock.

Does a Stock’s Dividend Amount Vary Relative to the Stock’s Price?

This figure accounts for interest, dividends, and increases in share price, among other capital gains. Proponents of dividends point out that a high dividend payout is important for investors because dividends provide certainty about the company’s financial well-being. Typically, companies that have consistently paid dividends are some of the most stable companies over the past several decades. As a result, a company that pays out a dividend attracts investors and creates demand for their stock. Advocates believe projected future cash dividends are the only dependable appraisal of a company’s intrinsic value. Most financial metrics used by analysts and investors in stock analysis are dependent on figures obtained from companies’ financial statements.

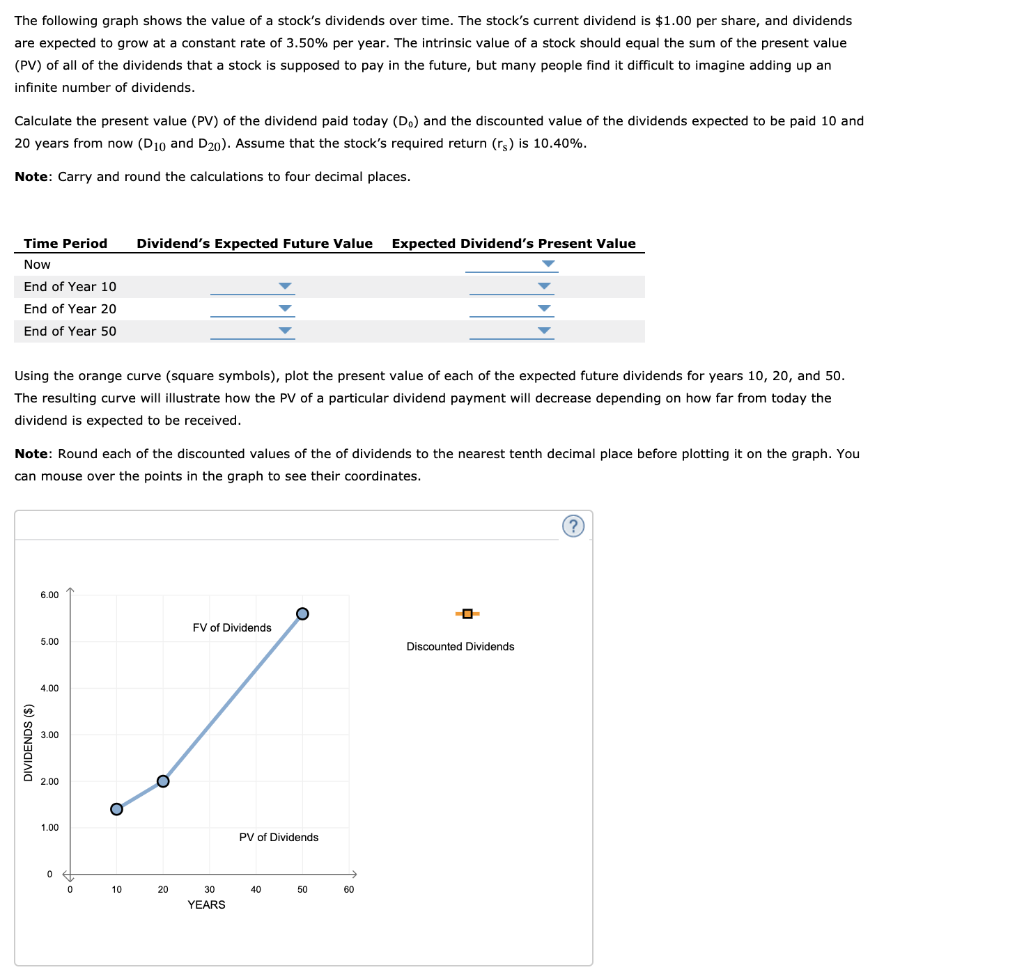

The Dividend Discount Model

This increased interest in the company creates demand increasing the value of the stock. At the same time, if the payout gets very high, say above 5, investors should ask whether management is withholding excess earnings and not paying enough cash to shareholders. Managers who raise their dividends are telling investors that the course of business over the coming 12 months or more will be stable. Unlike cash dividends, stock dividends are not taxed until the investor sells the shares. A dividend is a portion of a company’s profits that are paid to its shareholders periodically, in the form of cash or additional shares, as a reward for their investment in the company. One of the world’s most profitable companies—tech giant Google—has never paid investors a dividend.

Featured Partner Offers

Contact the product issuer directly for a copy of the PDS, TMD and other documentation. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved or otherwise endorsed by our partners. Stocks that pay dividends are a pillar of income investing, favoured by many investors looking to retire or earn a living from the stock market. If you’re investing in the stock market, it’s important to understand the role of dividends and why companies pay them, so you can adjust your investing strategy accordingly. Your investment is $8,000 and the stock pays an annual dividend of $1.20 per share (that’s a yield of 3%).

- Dividend payments reflect positively on a company and help maintain investors’ trust.

- This entry transfers the value of the issued stock from the retained earnings account to the paid-in capital account.

- If a company has one million shares outstanding, this would translate into an additional 50,000 shares.

- You will receive $0.50 per share in the dividend, but you’ll lose $0.50 per share because of the decline in the stock price.

When you evaluate a company’s dividend-paying practices, ask yourself if the company can afford to pay the dividend. The ratio between a company’s earnings and the net dividend paid to shareholders—known as dividend coverage—remains a well-used tool for measuring whether earnings are sufficient to cover dividend obligations. The ratio is calculated as earnings per share divided by the dividend per share. When coverage is getting thin, odds are good that there will be a dividend cut, which can have a dire impact on valuation.

That reduction in the company’s « wealth » has to be reflected in a downward adjustment in the stock price. An investor who owns a dividend-paying stock has an expectation can freshbooks do taxes of receiving income. After a dividend is paid, there is no longer the expectation of this income; the stock price adjusts downward to reflect this lower expectation.

In addition to the set dividend, companies can offer an extra dividend paid only when income exceeds certain benchmarks. The company may choose a cyclical policy that sets dividends at a fixed fraction of quarterly earnings, or it may choose a stable policy whereby quarterly dividends are set at a fraction of yearly earnings. In either case, the aim of the stability policy is to reduce uncertainty for investors and to provide them with income.

Examining a company’s current and historical dividend payout gives investors a firm reference point in basic fundamental analysis of the strength of a company. Dividends provide continuous, year-to-year indications of a company’s growth and profitability, outside of whatever up-and-down movements may occur in the company’s stock price over the course of a year. Even investors who do not need a regular stream of income prefer dividend-paying stocks, since regular dividends send a strong message about the financial viability of the corporation. Dividend payments are at the sole discretion of the board of directors.

Based on that dividend, you expect to receive $240 in dividends the first year. If that dividend stream never changes, you will recoup your initial $8,000 investment in roughly 33 years. In other words, your payback period would be reduced by some 13 years. As with cash dividends, smaller stock dividends can easily go unnoticed. A 2% stock dividend paid on shares trading at $200 only drops the price to $196.10, a reduction that could easily be the result of normal trading. However, a 35% stock dividend drops the price down to $148.15 per share, which is pretty hard to miss.

The dependability of dividends is a big reason to consider dividends when buying stock. For example, Procter & Gamble, the consumer-products giant, has paid a dividend every year since 1891. Procter & Gamble’s stock price has not risen every year since 1891, but shareholders who owned the stock were still paid dividends during those down years.