09 Nov What is Fixed Overhead Spending Variance? Definition, Formula, Explanation, And Analysis

However, during the period cost rationalization measures were carried out and fixed overheads were reduced by minimizing inefficiencies resulting in an annual fixed overhead expense of $420,000. Actual production volume is the production that the company actually achieves (in hours) or produces (in units) during the period. The figure in hours here can either be labor hours or machine hours depending on which one is more suitable for the measurement in the production.

What is Variance Analysis? Definition, Explanation, 4 Types of Variances

- An unfavorable variance may occur if the cost of indirect labor increases, cost controls are ineffective, or there are errors in budgetary planning.

- Since the fixed manufacturing overhead costs should remain the same within reasonable ranges of activity, the amount of the fixed overhead budget variance should be relatively small.

- Overhead variances arise when the actual overhead costs incurred differ from the expected amounts.

The following information is the flexible budget Connie’s Candy prepared to show expected overhead at each capacity level. Budget or spending variance is the difference between the budget and the actual cost for the actual hours of operation. This variance can be compared to the price and quantity variance developed for direct materials and direct labor. Using the information given below, compute the fixed overhead cost, expenditure, and volume variances.

What are two types of overhead cost variances?

Other than the two points just noted, the level of production should have no impact on this variance. The standard variable overhead rate is typically expressed in terms of the number of machine hours or labor hours depending on whether the production process is predominantly carried out manually or by automation. A company may even use both machine and labor hours as a basis for the standard (budgeted) rate if the use both manual and automated processes in their operations. Since the fixed manufacturing overhead costs should remain the same within reasonable ranges of activity, the amount of the fixed overhead budget variance should be relatively small. Companies typically establish a standard fixed manufacturing overhead rate prior to the start of the year and then use that rate for the entire year. Let’s assume it is December 2022 and DenimWorks is developing the standard fixed manufacturing overhead rate for use in 2023.

Related AccountingTools Course

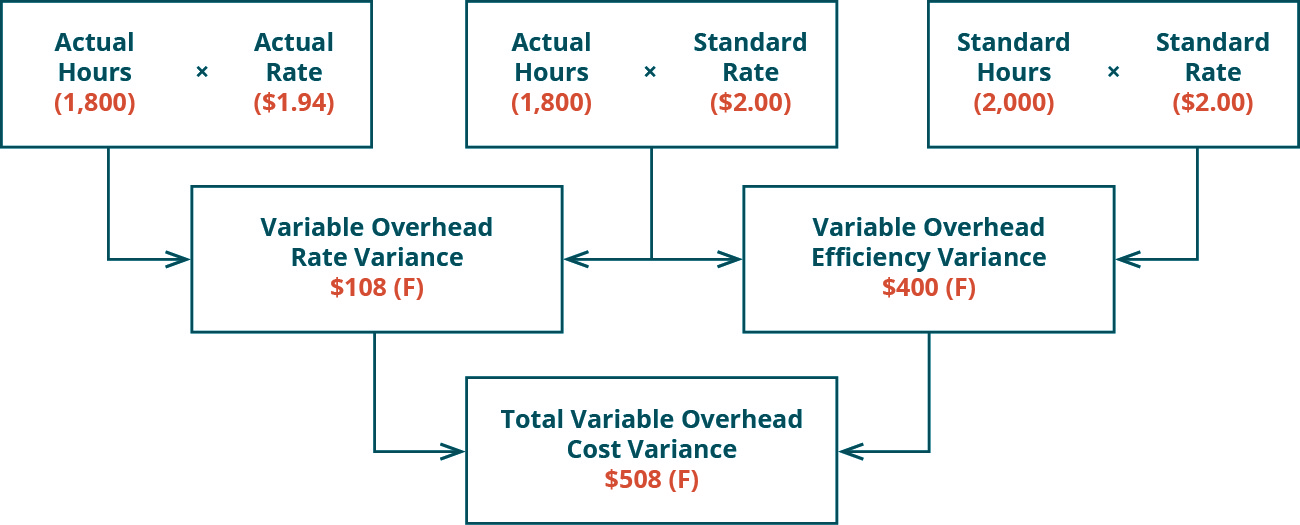

Overhead variances arise when the actual overhead costs incurred differ from the expected amounts. Managers want to understand the reasons for these differences, and so should consider computing one or more of the overhead variances described below. It is not necessary to calculate these variances when a manager cannot influence their outcome. Connie’s Candy used fewer direct labor hours and less variable overhead to produce \(1,000\) candy boxes (units). Usually, the level of activity is either direct labor hours or direct labor cost, but it could be machine hours or units of production.

If the fixed overhead cost applied to the actual production using the standard fixed overhead rate is bigger than the budgeted fixed overhead cost, the fixed overhead volume variance is the favorable one. This means that the company’s actual production volume measured in units or hours during the period is more than the budgeted production volume that the company has previously planned. Fixed overhead volume variance is the difference between the budgeted fixed overhead cost and the fixed overhead costs that are applied to the actual production volume using the standard fixed overhead rate.

What are the formulas to calculate the overhead variances?

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

The debit balance on the fixed overhead volume variance account (1,040) has been charged to the cost of goods sold account, and both variance account balances have been cleared. Connie’s Candy used fewer direct labor hours and less variable overhead to produce 1,000 candy boxes (units). (c) In addition, prepare a reconciliation statement for the standard fixed expenses worked out at a standard fixed overhead rate and actual fixed overhead.

Fixed overhead variances are particularly important when it comes to variance analysis. A variance analysis compares all the budgeted figures with the actual figures and analyzes the reasons behind such differences. Fixed overhead costs are expenses that do not vary with changes in production or sales volume, such as rent, insurance, property taxes, and depreciation. Total overhead tax estimator to calculate your 2014 tax refund cost variance can be subdivided into budget or spending variance and efficiency variance. This could be for many reasons, and the production supervisor would need to determine where the variable cost difference is occurring to make production changes. Sometimes these flexible budget figures and overhead rates differ from the actual results, which produces a variance.